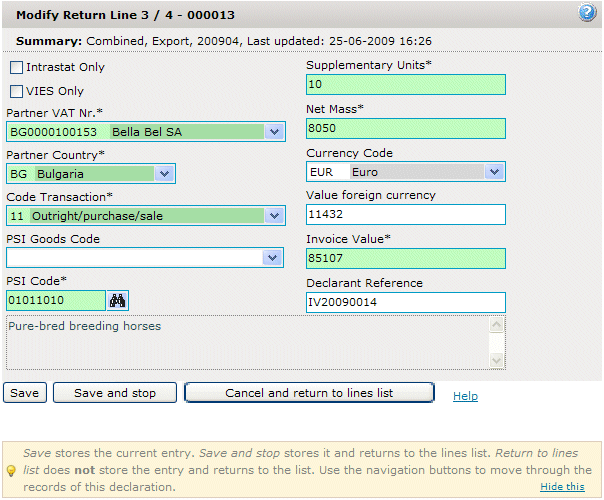

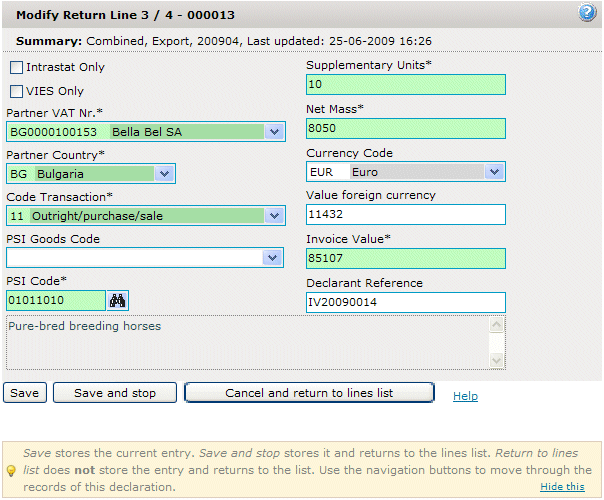

Entry of a declaration line. Depending on the kind of survey you have selected, the fields that can be filled in vary.

The following screen shows a combined Intrastat /VIES declaration line. Other survey types might require only a subset of these fields to be entered. For ETS also the service code is required. This is further explained below.

The header shows the line number, 3 out of a total of 4 in this case plus declaration number: 13.

After that follows:

The Survey Type of the declaration: Combined Intrastat and Vies

The Declaration Flow: Export

The Period for which we report: April-2009

The data and time when this line was last saved: 25th of June 2009 at

16:26

By default all VIES and Intrastat fields can be entered. One can however decide

to only report this line for Intrastat or only for Vies by checking one of the

next two boxes.

When Intrastat onlyis checked the VAT number is no longer required,

when VIES only is checked only the VAT number plus 3 values are required. For a description of these values see the paragraph on VIES declarations below.

Partner VAT Nr.:

The VAT number of the trade partner. It can be entered directly of selected from a

list of trade partners you defined earlier. See Trade Partners

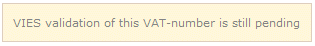

for more details. When a VAT number is entered it is checked whether it is a correct

and registered number. When it is not in compliance with the algorithm rules of

the country where the trade partner resides the field will turn red, in error.

Otherwise it will turn green and the number is checked to see if it is properly

registered in that country. When the number has already recently been checked

the message if it’s correct or not will be given immediately. Otherwise you will

see the following message displayed.

Should it later turn out the this trade partner is not registered, you will be

notified by a message (See Messages) it is then up to

you to decide whether or not this trade partner is indeed valid.

Partner country:

- Declaration of Dispatch: Member state to which the goods are exported.

- Declaration of Arrival: Member state from which the goods are imported.

Nature of transaction:

Indicates the commercial transaction (e.g. 11 = all transactions involving purchase and

sale ; 21 = Return of goods).

PSI Goods Code:

Internal goods code of the company (Can be defined by the users. View “PSI Info /

Good Codes”)

Cn8 Goods Code:

Official goods code. This goods code can be picked up in the official nomenclature.

Description of the kind of goods.

Supplementary units:

Indicates the quantity of the goods as described behind the field Cn8 goods code (e.g.

“pieces”. You have to indicate how many pieces of these

products were imported or exported.

Net mass:

The total mass of the goods. (not the weight per unit!)

Currency code:

Indicates in which foreign currency the field “Invoice value Foreign” is

expressed.

Invoice value Foreign Currency:

Invoice value expressed in the foreign currency described in the field “Currency

code”.

Invoice value Danish Crowns:

Invoice value in Danish Crowns. This value can be a calculation from the foreign currency value.

Declarant Reference Number

This field is not required. It can be used to enter an invoice number, the name of the

trade partner or any other reference.

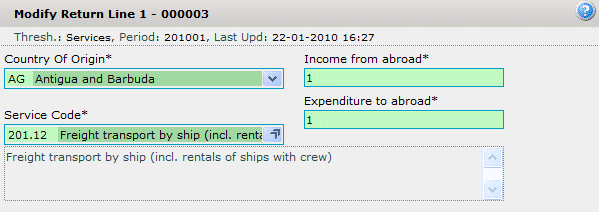

For an ETS declaration this form looks slightly different. ETS only requires a Partner Country, a Service Code and one or two values to be entered. The form looks as follows:

Partner Country:

The required ISO country code can be that of any country in the world or an institution.

Service code:

Any of the codes in the list can be either directly typed in or selected from

the list by pressing the button to the right of the list. The latter will pop-up

a list which you can browse and select from.

Income from abroad: A value in Danish Crowns is required. For some service codes this value is not applicable and when such a code is selected the field disappears from the screen. A special case forms service code 200.12 for which a negative value is required.

Expenditure to abroad:

A value in Danish Crowns is required. For some service codes this value is not

applicable and when such a code is selected the field disappears from the

screen.

Please note that it is required to fill-in at least one of the two value fields.

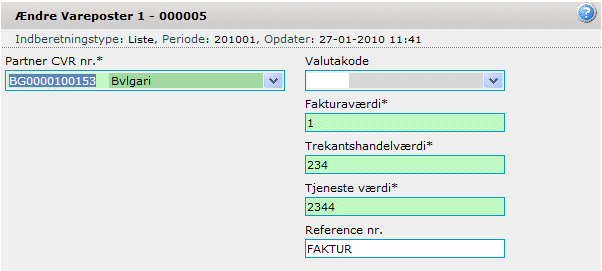

Although a VIES line can be entered in combination with Intrastat information (see the combined line described above), it is in many cases easier to only enter VIES information.

Invoice Value:

A value in Danish Crowns is required describing trade figures related to goods for the specified Trade Partner.

Triangular Value:

A value in Danish Crowns is required describing triagular transaction related trade figures for the specified Trade Partner.

Service Value:

A value in Danish Crowns is required describing trade figures related to services for the specified Trade Partner.

A dedicated VIES declaration or a VIES-Only detailed line of a combined declaration are the only places where a triangular value or service value can be entered, since triangular trade and services are incompatible with Intrastat.

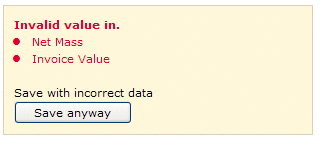

At any point in time you can save the data you have so far entered in the form. This is unlike other forms in IDEP that can only be saved when all mandatory fields have been correctly filled-in. You have the possibility to Save and Continue which will save the line and open new empty one or you can Save and Stop which will bring you back to the list of declaration lines.

When one or more fields are still in error, you will be presented with the message:

You now have the choice of either saving the form with the error(s) or correcting it first.